Imagine a transportation method that will allow for you to travel from San Francisco to London in 30 minutes. We used to have a supersonic plane called the Concorde that would allow for a person to fly from New York to Paris in 3.5 hours instead of the 7 it takes on a normal plane. The trip from San Francisco to London is even further, but this new mode of transportation would allow for you to make it in less than 30 minutes.

How would that change the world? You are working on a complex business arrangement and you need to meet with people on the multiple continents as quickly as possible. Soon you will be able to. Meet in Washington in the morning, go to Beijing for lunch and then finish it off in San Francisco for dinner.

Today in Australia, Elon Musk proposed just such a system that his company SpaceX will start to build within the next year. While the benefits of quicker travel between points on earth is compelling, that primary motivation is even more visionary.

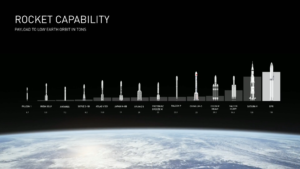

The goal of the BFR (Big Falcon Rocket) is to lower the cost of space travel while at the same time increasing the capacity. The BFR is more capable than any rocket that has ever been produced or is planned to be produced.

The BFR is more powerful than the Saturn V which was the rocket that took Buzz Aldrin to the moon.

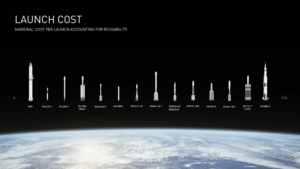

Taking this same set of rockets and sorting them by increasing launch costs puts the BFR on the other side of the list:

While the BFR will be more costly to build than any of those other rockets, those costs can be spread out over multiple flights since it is 100% reusable. Some argue that reusability costs performance, and it is true. But you could improve the performance of airplanes by not having landing gear or flaps. And use those weight savings to give a slightly more cargo capacity. Instead of landing the plane you could use parachutes to land the cargo and let the plane crash in the sea. Sounds crazy. No one would consider doing that. But that is exactly the same thought process that has driven rocket design since its beginning. And we have just lived with it. Never questioning the absurdity of it.

We have seen space art like this in the past. It has always been like a mirage. Always just over the next horizon:

But this does not feel like a mirage. The resources that have developed, built and operated the Falcon 9, the Dragon Capsule, and the Falcon Heavy will be deployed full-time on the BFR project within the next year. And Elon is planning to use the BFR as the sole rocket to service his customers going forward.

Take a look at his presentation and get a glimpse of the future: